Dallas–Fort Worth Home Prices vs U.S. Market | The Tail-end of 2025

In September 2025, U.S. home prices continued to inch upward while listing inventory broadly climbed to–or above–pre-pandemic levels, suggesting the market is gradually shifting from its recent break-neck pace. the median price of a home rose about 2 percent in September compared to a year earlier.

National backdrop

-

According to National Association of Realtors (NAR) data, the U.S. median existing-home sales price reached around $404,500 in September 2024, up about 3 percent year-over-year.

-

More recently, the national median sale price in September 2025 was approximately $435,495, representing a ~1.8 percent annual increase.

-

On supply, the U.S. had about 4.6 months of existing‐home inventory in August 2025, up from ~4.2 months a year prior.

-

By one measure, active listings in the U.S. reached about 1.53 million units in August/September 2025—an ~11.7 percent increase year-over-year.

These numbers point to a national market that is no longer locked in hyper-growth mode: prices are still elevated, but inventory is expanding and time on market is creeping up. Listings have now “topped pre-pandemic levels.”

Dallas-Area Snapshot (Select North Texas Counties)

Here are recent figures for counties in the Dallas–Fort Worth metroplex, compared to the national median and national inventory trends:

-

Dallas County: According to a DFW market update, the median sales price in September 2025 was about $365,000, with roughly 4.8 months of inventory. Meanwhile, Zillow’s Home Value Index for Dallas County as of September 2025 shows a typical value of ~$305,857, down about 5 percent year-over-year.

-

Tarrant County: For September 2025, the median sale price was approximately $345,000, essentially flat year-over-year, with about 3.8 months of inventory.

-

Collin County: Redfin reports a median home price of about $450,000 in September 2025, down around 6.3 percent from the prior year; homes were taking longer to sell (69 days vs. 55 days).

-

Denton County: The market update cited a median sales price of $435,000 in September 2025, with around 4.7 months of inventory. dfwhomeinfo.com

-

Rockwall County and Kaufman County: I was unable to locate reliable publicly published median-price or full inventory figures for these two counties for the exact September 2025 period.

How these local markets compare to national

-

On price: The national median sale price (~$435,495) is higher than the figures for Dallas County ($365k), Tarrant ($345k), Denton ($435k) and Collin County ($450k) sits closer to the national level.

-

On inventory: The U.S. has roughly 4.6 months of supply; Dallas County at ~4.8 months and Tarrant at ~3.8 months imply that Dallas County is near the national level while Tarrant and Denton remain relatively tighter (fewer months of supply = stronger seller’s market).

-

On price-growth: While U.S. prices are rising (1.8 % year-over-year), Collin County’s median price in September 2025 was down ~6.3 % year-over-year. Dallas County’s price also edged lower (data shows ~-5%). This suggests some local market cooling relative to the national average.

Zooming into year-over-year change (Sept 2024 → Sept 2025)

-

National median price: up ~1.8%.

-

Local:

-

Collin County: down ~6.3% year-over-year in median sale price.

-

Tarrant County: essentially flat (0.0% change) at ~$345k.

-

Dallas County: the DFW update suggests ~$365k median price in Sept 2025 but I do not have the exact September 2024 figure in that source; Zillow indicates a downward trend (~-5% year over year).

-

-

Inventory: At the national level, inventory has risen ~11.7 percent year-over-year. At the local level, active listings in the Dallas–Fort Worth MSA reached ~30,064 in September 2025 for the Dallas–Fort Worth MSA; that’s up relative to prior years.

-

Months of supply: Dallas County ~4.8 months in September 2025. That is still below the 6 months or more that typically denotes a “buyer’s market.”

Implications

-

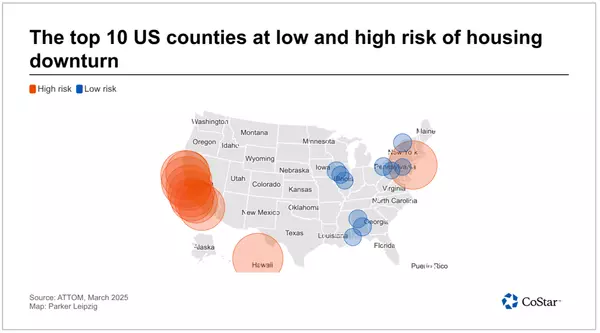

The national market is slowly moving toward more balance—but is still tilted toward sellers, given months of supply under 6 and prices still rising (albeit modestly).

-

In many North Texas counties, the market appears to be cooling relative to national averages: prices are flat or declining, inventory is rising, and time on market is increasing.

-

For buyers: This may be a window of opportunity in the Dallas–area as seller leverage weakens (especially in counties where inventory is increasing and price growth is slowing).

-

For sellers: It suggests caution—continued rapid price appreciation is unlikely, and markets are showing signs of entering a more normalized phase.

-

For investors/market watchers: The divergence between local markets and the national average indicates the importance of local data (county by county) rather than relying solely on national trends.

Final Thoughts and Summary

as we head into the final stretch of 2025, the U.S. housing market — and especially the Texas markets we highlighted — are showing clearer signs of stabilizing and re-energizing. With the average 30-year fixed mortgage rate dropping to about 5.98 % as of October 2025. Over the past eight quarters we’ve seen rates slide from their peak (in the 7%+ range in 2023-24) into the mid-6% range, giving buyers, sellers and investors a fresh dose of confidence.

Here’s why that matters: Lower borrowing costs expand the pool of qualified buyers, and when coupled with the rising — albeit gently — inventory levels and more moderate price increases (or even slight declines in some Texas counties), we’re moving towards a more balanced market. In Texas — particularly in counties like Dallas County, Collin County and Denton County — that means more choices, less intense bidding wars, and a more rational pace of growth. That’s excellent news for first-time home buyers who’ve felt locked out, for sellers who may have been waiting for the “perfect moment,” and for investors seeking markets with upside but less risk.

So yes — there are always headwinds (inflation, regional supply constraints, shifting migration patterns) but right now the prism through which we view the U.S. and Texas housing markets is decidedly brighter. Lower interest rates + improving inventory dynamics + less overheated price growth = a healthier, more sustainable environment. If you’re considering buying, selling or simply watching your local market, this could be the moment to lean in rather than lean back.

***Sources:

Categories

Recent Posts

GET MORE INFORMATION