Study Reveals: What U.S. Counties Are Most at Risk for a Housing Downturn?

Soaring Home Prices & Stagnant Wages Threaten Affordability in Key Markets

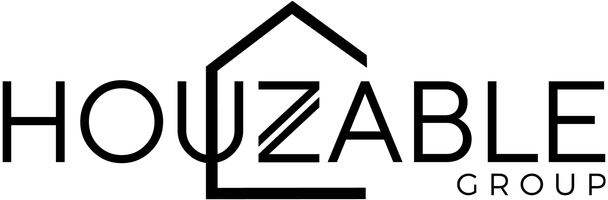

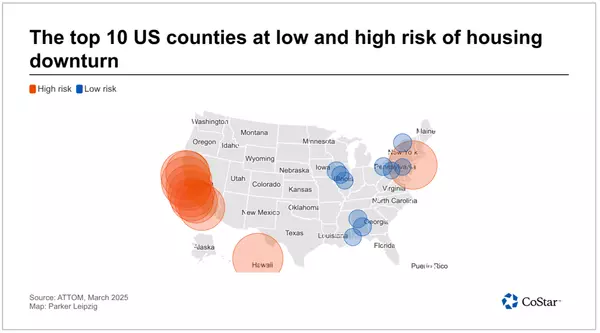

A new study by ATTOM has identified the U.S. counties most vulnerable to a housing downturn, with New York and California topping the list. The primary culprit? Home prices surging faster than wages.

According to the report, roughly 50 counties are at heightened risk, largely because local wage growth hasn't kept up with rising property values—a trend that has intensified since the pandemic.

The Growing Gap Between Wages & Home Prices

Federal Reserve data shows wages have risen about 24% since 2020, but home prices have skyrocketed by 47% in the same period, according to the Case-Shiller National Home Price Index. This growing affordability gap means homeownership costs are eating up more than three times the portion of average wages in some areas compared to others, the study notes.

“This report isn’t about predicting doom or nonstop growth,” said ATTOM CEO Rob Barber. “It simply highlights areas experiencing more or less market pressure—factors that could impact home values, foreclosure rates, and homeowner equity.”

Where’s the Risk — and Where’s It Safer?

While New York and California dominate the list of high-risk markets, the study also found that Wisconsin and Tennessee counties rank among the least vulnerable to a downturn, offering more stable housing conditions.

Brooklyn Homeowners Cashing Out?

Real estate agent Mable Ivory of Real Broker has noticed a shift in Brooklyn, where some homeowners are sensing the peak of the market and deciding to sell.

“Many homeowners who’ve built up significant equity are listing now to cash out,” Ivory said. “They're taking advantage of their gains to buy in more affordable markets—sometimes even picking up an investment property with the extra proceeds.”

For those still looking to buy in Brooklyn, this could present an opportunity.

“With NYC rents at a 50-year high and climbing, locking in a mortgage at or below current rent prices could make homeownership a smart move right now,” Ivory added.

Bottom Line

While some housing markets face rising risks, others remain stable. For buyers and sellers alike, understanding these trends can help in making informed real estate decisions.

Source: By Khristopher J. Brooks at Homes.com

Categories

Recent Posts

GET MORE INFORMATION