Why We’re Not Heading for a 2008 Housing Market Crash — Especially Not in Texas

Every few months, the internet starts buzzing with talk of a looming “housing crash,” and lately, some sellers and buyers in the Dallas-Fort Worth area are wondering if the market is heading the way of 2008. It’s a fair question—but here's the good news: This market is very different, and the data tells a much more stable story.

Let’s break down why a repeat of 2008/2009 isn’t likely—and why Texas, and especially DFW, is in a solid position to weather any national slowdown.

What Actually Happened in 2008?

To understand why we’re not heading for another crash, it’s important to understand why the last one happened in the first place:

-

Lenders handed out risky loans—think zero-down, no-income-verification, adjustable-rate mortgages (ARMs) to buyers who couldn’t actually afford the homes.

-

When rates adjusted and payments jumped, millions defaulted on their loans.

-

This triggered a wave of foreclosures, tanking home prices and flooding the market with distressed inventory.

-

Builders had also been overproducing, leading to massive oversupply.

-

The financial system, tied up in mortgage-backed securities, spiraled—causing the broader economic crash.

It was a perfect storm of bad lending, oversupply, and no guardrails. But today? The situation couldn’t be more different.

Why This Time Is Different

✅ Lending Standards Are Stricter

Gone are the days of "no-doc loans" and predatory lending. Today’s buyers are better qualified, with solid credit, income verification, and skin in the game.

- 2008 vs 2025 total average household debt was 85.8% in 2008 versus 61.7% in 2025.

- Stricter underwriting: rigorously verify borrowers assets, income, and debts (including Debt-To-Income ratio)

- Limit risky loans like interest only or loans with large baloon payments

- Creation of the CFPB to protect borrowers from predatory lending practices

- Compared to the European G7 countries seeing increases around 11%, American expendable income has increased more than 29% since 2008; while Italy decreased 5.3% and Japan increased 2%.

- Enhanced bank regulation & oversight, the Dodd-Frank Act, Stricter oversight of Government Sponsored Enterprises (GSE's) like Fannie Mae & Freddie Mac, and much more

✅ Inventory Is Still Low

In 2008, we had 10-12 months of housing inventory in many markets. In DFW right now? We're hovering around 3 months of inventory. That’s still a seller’s market. It would take a big increase in listings and a big drop in demand to shift the balance—and we’re not seeing that.

✅ Homeowners Have Equity

The vast majority of homeowners today have significant equity in their homes, thanks to price appreciation over the last 5+ years and responsible lending. That means less risk of widespread foreclosures.

But… Are Home Prices Dropping in DFW?

In some areas—yes, homes are adjusting in price, but that’s not a crash… it’s a normal market correction.

Here’s what’s happening:

-

Sellers who listed at 2021 peak pricing (when rates were still ~3%) are having to adjust expectations in today’s 7%+ rate environment.

-

Affordability has shifted—buyers can’t stretch like they used to, which means homes need to be priced accordingly.

-

Well-priced homes are still selling, often quickly. Overpriced homes are sitting and seeing price reductions.

That’s not a crash. That’s a return to market fundamentals—where pricing, presentation, and demand all matter.

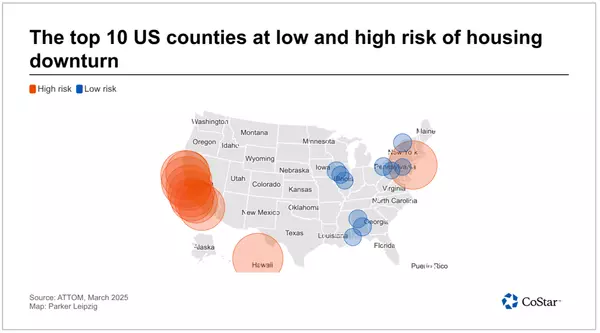

Why Texas Is in a Unique Spot

Texas—and particularly the DFW metroplex—isn’t just holding steady… it’s still one of the most desirable places to live and invest in the country.

Here’s why:

✔️ Population Growth

DFW continues to see strong population growth. People are still moving here from high-cost states like California and New York for jobs, affordability, and quality of life.

✔️ Business-Friendly Economy

Major companies are relocating or expanding in North Texas, keeping job growth strong and housing demand healthy.

✔️ Diverse Housing Stock

DFW offers a wide range of housing—from urban condos to suburban new builds—keeping supply flexible and less vulnerable to massive over- or underbuilding.

✔️ Local Market Data Looks Nothing Like 2008

Let’s compare:

| Metric | 2008 DFW Market | 2025 DFW Market (Now) | |

|---|---|---|---|

|

Inventory |

9–12 months | ~3 months | |

|

Days on Market |

60–90+ days | 30–45 days (avg) | |

| Lending Standards | Extremely Loose | Tightly Regulated | |

|

% of Buyers with Equity |

Low | Very High | |

|

Foreclosures |

Surging | Still Historically Low |

Bottom Line: A Crash Isn’t Coming

Are we seeing a cooling market compared to the frenzy of 2020–2021? Absolutely. And that's a good thing. Normal markets have negotiation, due diligence, and realistic pricing—unlike the free-for-all of the COVID years.

But is this 2008 all over again? Not even close.

In DFW and across much of Texas, demand remains strong, inventory is low but growing at a healthy pace, and buyers and sellers alike are adapting to the new interest rate environment.

If you're thinking about selling or buying and want to make a smart move in today’s market, let’s talk. Understanding your options (and your local market) is the key to winning—no matter where we are in the cycle.

Categories

Recent Posts

GET MORE INFORMATION